Bitcoin's $60K Crash Wasn't Random. Here's Who Actually Caused It.

Last week, Bitcoin fell off a cliff. From $77,000 to $60,000 in three days. Billions evaporated. Twitter was full of "I told you so" posts and panic threads.

But most people missed what actually happened. This wasn't just selling pressure from scared retail traders. The crash had invisible architects. And understanding who they are changes how you think about what happens next.

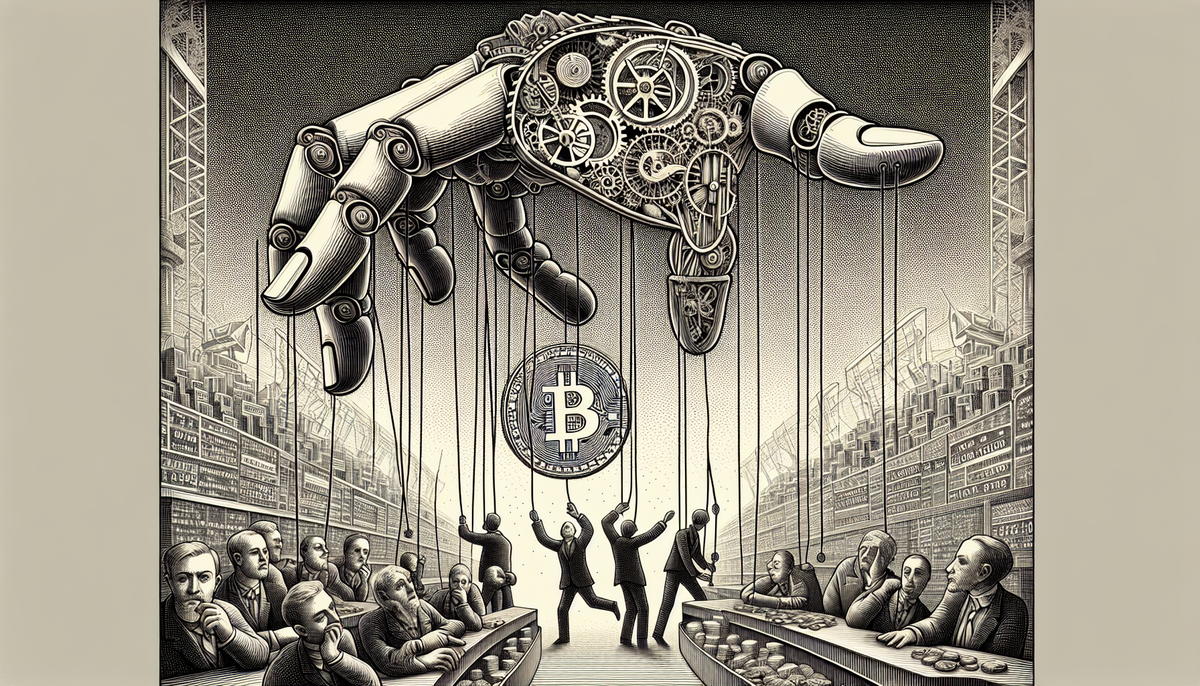

THE INVISIBLE HANDS

When Bitcoin dropped below $75,000 on Tuesday, something mechanical kicked in. Options market makers, the firms that sit on the other side of every options trade, were sitting on roughly $1.5 billion in "negative gamma" between $60,000 and $75,000.

I know that sounds like jargon. Let me break it down.

These firms don't bet on price direction. They make money from the spread between buy and sell orders. But they need to constantly hedge their exposure. And when they're "short gamma," any price move forces them to trade in the same direction.

So as Bitcoin fell, they had to sell more Bitcoin to stay hedged. Which pushed the price lower. Which forced them to sell even more.

It's a self-feeding loop. 10x Research founder Markus Thielen called it out in a client note on Friday. The negative gamma between $75K and $60K "played a critical role in accelerating Bitcoin's decline," he wrote. The sharp bounce once we hit $60K? That's where the last big gamma cluster got absorbed.

Think of it like an avalanche. The snow was already loose. But the market makers were the ones who kicked it downhill.

MINERS ARE QUITTING

While dealers were dumping Bitcoin to hedge their books, the people who actually produce new coins were getting crushed too.

Mining difficulty just dropped 11%. That's the biggest single drop since China banned mining in 2021. The metric went from 141.6 trillion to 125.86 trillion, which tells you a huge number of machines went dark.

Why? Three reasons stacked on top of each other.

First, revenue per petahash got cut in half. At Bitcoin's October high of $126,000, miners earned about $70 per petahash. Now it's $35. Running older equipment at those numbers means burning cash every day you stay online.

Second, winter storms slammed Texas, where a massive chunk of U.S. mining operations are based. Grid operators told miners to shut down so residential customers could keep their lights on. Some public mining firms saw daily output drop by more than 60%.

Third, and this one's interesting, some miners aren't even bothering to come back. Bitfarms said last week it's "no longer a bitcoin company." They're pivoting to AI data centers because the contracts are more stable and the margins are better. You can't really blame them.

The difficulty drop is actually a self correcting mechanism. Fewer miners means the remaining ones find blocks faster and earn more per unit of hashpower. But the fact that we're seeing 2021 level capitulation tells you the pain is real.

SMART MONEY IS BUYING THE BLOOD

Here's where the story gets interesting. While retail was panicking and miners were shutting down, some very large players were backing up the truck.

Michael Saylor's Strategy bought 1,142 Bitcoin for $90 million at an average price of $78,815. That was early in the week before the real carnage hit. His total stack now sits at 714,644 BTC, purchased for $54.35 billion. At today's price around $69,000, that's an unrealized loss of roughly $5 billion on paper. Saylor doesn't seem to care.

But the bigger headline is Tom Lee's Bitmine Immersion. They added 40,613 ETH last week during the crash, bringing their total to 4.3 million tokens. That's 3.6% of Ethereum's entire supply. Worth about $8.7 billion at current prices.

Lee called the pullback "attractive" given "strengthening fundamentals." The company stakes two thirds of its ETH, generating $202 million per year in yield. They're sitting on a $7.8 billion unrealized loss at an average buy price of $3,826, but they keep buying.

Whether that's conviction or stubbornness depends on your time horizon.

Meanwhile, Google searches for "capitulation" are spiking. Historically, that's been a contrarian signal. When everyone's googling the word, the selling is often close to exhausted.

THE JAPAN WILDCARD

And then Sunday happened.

Japan's Prime Minister Sanae Takaichi won a decisive "supermajority" in the general election. The Nikkei 225 surged to record highs above 57,000, up 3.4% in a single session. Gold popped past $5,000 per ounce. Bitcoin briefly touched $72,000.

The "Takaichi Trade" is essentially a bet on aggressive fiscal expansion. Her $135 billion stimulus package includes infrastructure spending and tax cuts. Both Trump and Treasury Secretary Bessent congratulated her.

It's a weird moment. You've got simultaneous capitulation signals in crypto and euphoria in Japanese equities. Bitcoin sitting at $69,000 feels like it could go either way.

TETHER'S QUIET GOLD RUSH

One more thing worth noting. While everyone was focused on Bitcoin's crash, Tether has been silently becoming one of the world's largest gold holders.

Jefferies estimates Tether now holds 148 tonnes of physical gold worth $23 billion. That puts them in the top 30 global holders of bullion, ahead of countries like Australia, South Korea, and the UAE. Their quarterly gold buying exceeded most individual central banks.

CEO Paolo Ardoino wants to allocate 10 to 15% of Tether's investment portfolio to physical gold. They're reportedly buying up to $1 billion per month and storing it in what the press calls a "James Bond bunker."

When the biggest stablecoin issuer in crypto is hedging into physical gold at this scale, that tells you something about how they see the world.

WHAT HAPPENS NOW

This week is loaded. Coinbase and Robinhood report earnings. The U.S. jobs report drops Friday. Derivatives data shows a clear risk off shift. Futures open interest fell from $19 billion to $16 billion. Funding rates flipped negative on major exchanges. Options traders are paying huge premiums for downside protection.

The short term picture is ugly. I won't sugarcoat that.

But the structural buyers haven't left. Strategy keeps stacking. Bitmine keeps stacking. Value investors are moving in as capitulation searches rise. And Japan's election win just injected a shot of macro optimism into global markets.

We've been here before. The 2021 China mining ban caused a similar difficulty crash and miner exodus. Bitcoin bottomed around $29,000 that summer and hit $69,000 by November.

I'm not saying that's what's coming. But when the machines that amplified the crash stop selling, the miners that survived get more profitable, and the big money keeps buying, you get conditions that historically look a lot more like a floor than a trapdoor.

The question isn't whether Bitcoin recovers. It's how long the pain lasts first.